The Federal Reserve Has Had a Diversity Crisis Long Enough

June 8, 2022

Powell's Fed getting more diverse, but big gaps remain

May 16, 2022

NPR Marketplace Report: Diversity in the Fed

May 12, 2022

Higher Black unemployment tests Fed's goal to be more inclusive

February 9, 2022

Higher Black unemployment tests Fed's goal to be more inclusive

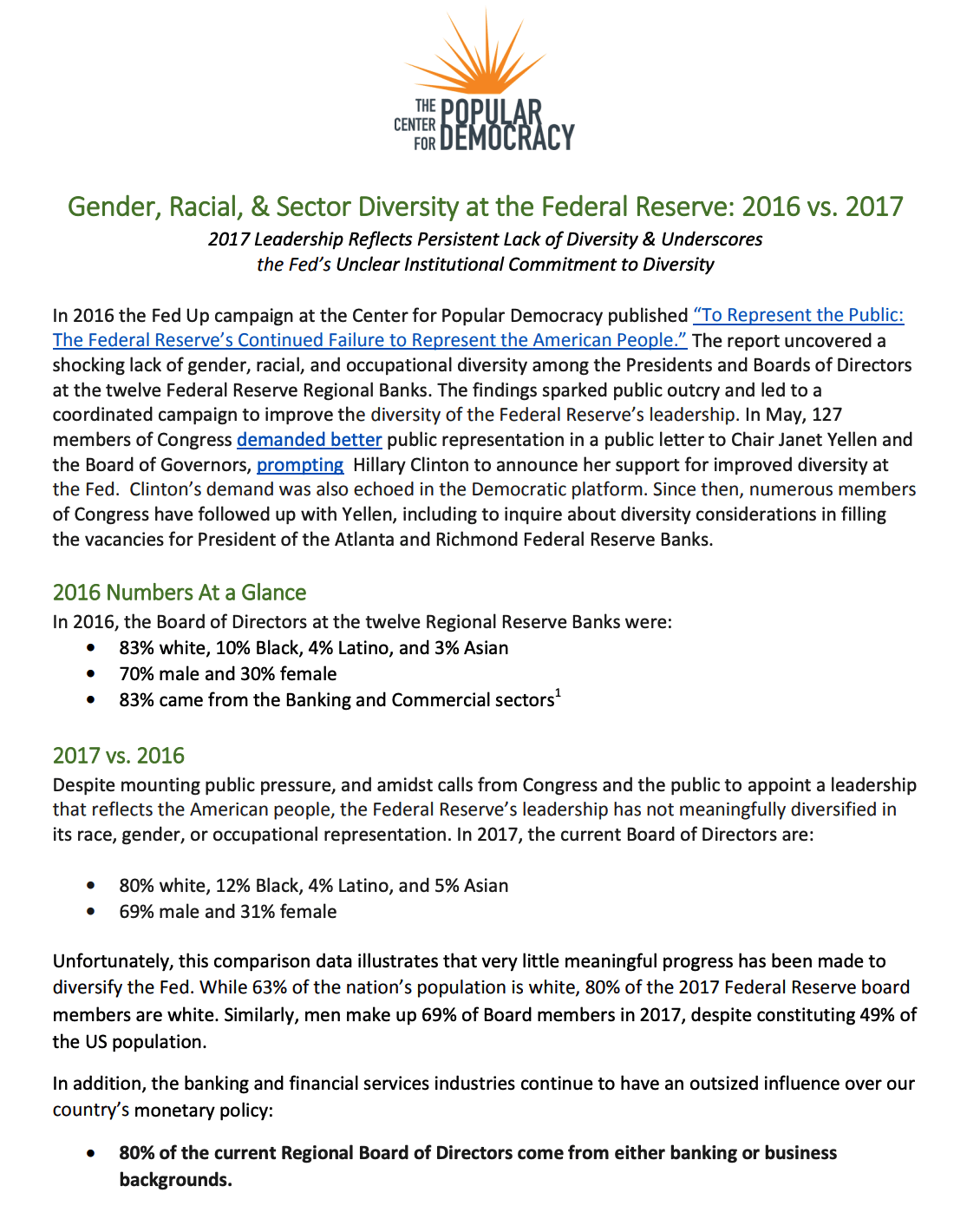

Regional Fed Boards Not Diverse Enough, Report Says

July 9, 2021

Biden Urged to Make Changes at Fed With Chair Decision in View

June 14, 2021